ics & cdars

Flexibility to diversify deposits

With ICS®, the IntraFi Cash Service®, and CDARS®, financial institutions can offer safety-conscious customers access to millions in aggregate FDIC insurance across network banks. Customer funds are placed into demand deposit accounts and money market deposit accounts with ICS and in CDs with CDARS.

How ICS and CDARS Work

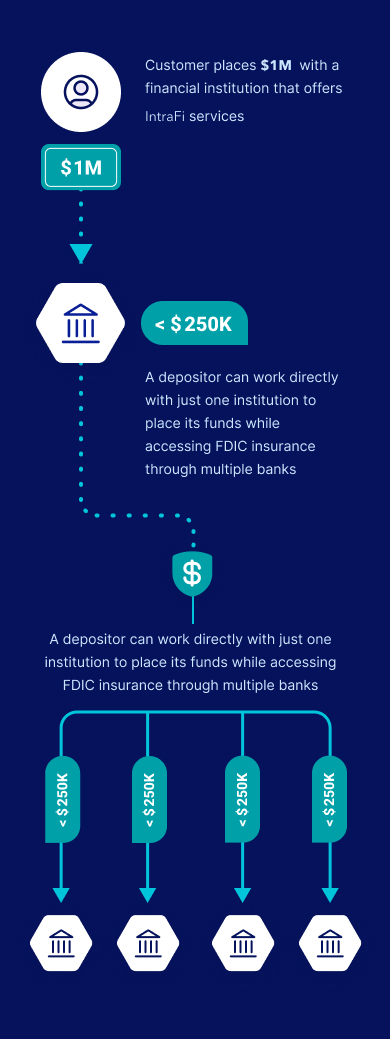

When a financial institution places large customer deposits in ICS or CDARS, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000 and is placed in deposit accounts at banks that participate in the network.

Customer places $1M with a financial institution that offers IntraFi services

A depositor can work directly with just one institution to place its funds while accessing FDIC insurance through multiple banks

Funds are placed into demand deposit accounts and money market deposit accounts with ICS and in CDs with CDARS

A list identifying IntraFi network banks can be found here. IntraFi is not an FDIC-insured bank, and deposit insurance covers the failure of an insured bank. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply.

Why do investors and bank customers choose ICS & CDARS?

Simple and streamlined, the services are chosen by businesses, nonprofits, and governmental organizations (e.g., cities and counties, public schools, police and fire districts), as well as fiduciaries, advisors, socially responsible investors, and individuals.

Peace of Mind

Through economic ups and downs and bank failures, no depositor has ever lost a penny of their funds placed using ICS and CDARS.

Flexibility

Multiple liquidity options provide control. Enjoy daily liquidity for funds placed through ICS into demand deposit accounts and money market deposit accounts. CDARS offers a range of maturities between 4 weeks and 3 years.

Favorable Returns

Risk-averse depositors do not have to sacrifice safety for returns. ICS and CDARS offer returns that compare to those earned from Treasuries and government money market mutual funds.

Time Savings & Transparent Reporting

Forego the need to manage multiple bank relationships. Know where your funds are at all times with an online dashboard and detailed reporting provided by your local bank relationship.

Reduced Collateralization Burden

Save time by eliminating the need to track changing collateral values on an ongoing basis or having to footnote uninsured deposits in financial statements.

Community Support

The full amount of your funds placed through IntraFi's services can stay local to support lending opportunities that build a stronger community.

Questions? See our Frequently Asked Questions.

Dare to Compare

See how the services stack up to collateralized deposits, letters of credit, private insurance, short-term bond funds, money market mutual fund sweeps, and other cash investment alternatives.

How ICS & CDARS from IntraFi® compare to other cash management alternatives.

Win-Win

Good for depositors. Good for financial institutions.

A depositor can work directly with just one institution to place its funds while accessing FDIC insurance through multiple banks.

The reciprocal deposits feature enables network banks to exchange their own customers' large deposits for a matching amount of deposits from other member banks in insurable increments (<$250K).

Banks can attract and retain large, safety-conscious customers, with or without keeping deposits on balance sheet.

Network members appreciate that they can buy deposits placed in ICS and CDARS from network members that are flush with cash. This allows them to diversify their balance sheet with funding that counts as deposits, not borrowings.

Fintechs can place customer funds in insured deposit accounts through a seamless integration with one or more participants in its bank network.

Brokerage firms and wealth managers can offer ICS and CDARS to help their clients keep funds safe while consolidating accounts from outside savings, investment accounts, and CDs, including those held in online banks.